When running an independent website, payment collection is a critical issue. Only by successfully receiving payments from customers can transactions be completed and revenue generated.

So what payment methods are available to independent websites? And how do payment preferences vary across different markets? Today, let’s dive into a comprehensive analysis!

Common Payment Methods for Independent Websites

PayPal

PayPal is one of the most popular payment platforms in the world, so it’s pretty much essential for anyone selling stuff abroad. It works with loads of the big e-commerce platforms out there, like Shopify, WooCommerce and AliExpress, making things so much easier for merchants. People trust PayPal, so it’ll boost your conversion rates and is super important for transactions on independent websites. It’s also got solid buyer protection policies, which give consumers more peace of mind in case there’s any drama.

And for those selling stuff, PayPal’s got your back with seller protection to help you avoid losing out on money to fraudulent transactions. OK, so the transaction fees might be a bit on the steep side, but it’s totally worth it for the convenience and the fact that it can really boost your conversion rates.Just keep an eye on how you handle disputes when you’re using PayPal, and make sure you’re getting the most out of your transactions.

Credit Card Payments

Credit cards are a popular choice for cross-border e-commerce transactions, especially with big names like Visa and MasterCard. Their popularity makes them a great option for cross-border sellers looking to connect with international buyers. They’re easy and flexible, and most people like them. This means that merchants can expect to see higher conversion rates.

But, as with anything, there are some drawbacks. For example, as a merchant, you’ll need to keep a security deposit on hand and stick to PCI DSS (Payment Card Industry Data Security Standard) regulations, which can end up costing you more in terms of operational costs. And, of course, there’s the risk of chargebacks and fraud, which is something to be aware of. Having said that, credit card payments are really convenient for consumers, so it’s a great way to reach a wider audience.

Local Payment Methods for Overseas Markets

MarketsLocal payment methods are customised payment solutions designed to match the preferences of consumers in specific regions. For example, in places like Europe or Southeast Asia, offering local payment options can make the shopping experience better and build trust with consumers. These methods not only cut currency conversion fees, but also make payments faster. Some of these systems even let you make instant transactions, which helps merchants get their cash flow going more quickly. They also reduce the risks of chargebacks and fraudulent transactions, so they’re safer for everyone.

But managing all these different systems can be tricky for merchants. Merchants need to know the rules of each market and set up a way to deal with problems that come up with multi-language and multi-currency payments

Cash on Delivery (COD)

Cash on Delivery (COD) is still a really popular payment method in some markets, especially in Southeast Asia and the Middle East. The reason for this is that people don’t have to pay up front, which makes them less likely to buy. So, it’s great for getting people to buy from you who might be a bit unsure about paying in advance.

It’s pretty efficient, but it does depend on logistics. If the delivery goes well, the merchant makes money. So it’s really important to team up with reliable delivery companies and make sure your customers get their orders on time. That way, you can keep your customers happy and make COD a profitable choice.

Cash on Delivery (COD) can boost order completion rates, but it makes logistics management more of a challenge for merchants. Merchants have to work with reliable logistics providers to make sure deliveries are made on time and reduce the number of failed deliveries.

Payment Preferences in Major Global Regions

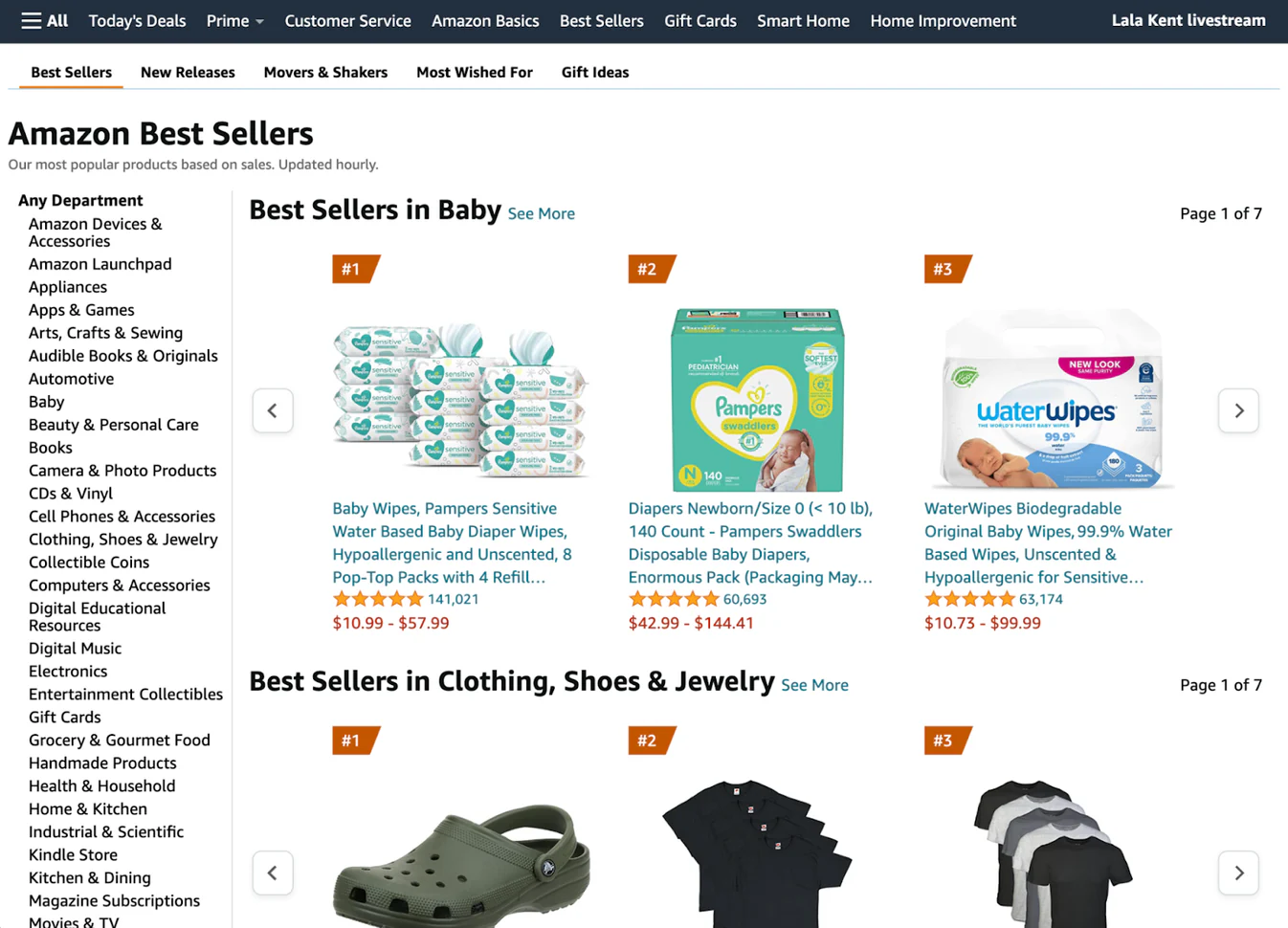

Payment methods vary widely across regions, shaped by culture and technology. Adapting to local preferences is key to winning customers and boosting sales in global markets. Here’s a quick look at payment habits around the world.

North America

A little about North American payment preferences Credit and debit cards are the market leaders with Visa, MasterCard, and American Express being household names. Credit cards, especially, remain the most preferred payment method for online shopping in the U.S. due to their convenience and strong security.

Meanwhile, digital wallets such as PayPal and Apple Pay are growing in popularity. Digitals wallets served 32% of online payments in 2022 and are projected to continue growing past 2025. Thanks to how easy they are to use, coupled with the additional consumer protection they offer, digital wallets have become more and more appealing to shoppers.

Europe

European payment preferences are varied by region on a whole new scale. As the largest e-commerce market in Europe, the UK is more reliant than many countries on credit cards, which are owned by an impressive 64% of consumers. Yet digital wallets like PayPal and Apple Pay are growing fast and becoming part and parcel of online transactions.

For countries like Germany and France, local payment methods take up a bigger part of the land. This is a reflection of the German consumer culture, which tends toward the cautious, and as such, Germans like using more secure options, including PayPal and bank transfers. Of course, in France credit cards rule, and although a lot of people use Visa and MasterCard here, the mostly of debit cards are Cartes Bancaires. These regional trends help shape our understanding of local payment preferences.

Asia-Pacific

Countries in the Asia-Pacific region, such as China, Japan, and South Korea, are leading the world in mobile payment adoption. In China, dominant mobile payment platforms like Alipay and WeChat Pay provide not only convenience, but shopping, social and financial services in one integrated platform.

Mobile payments, although they have not completely won the country, are gaining ground, particularly among younger consumers, as cash and credit cards retain popularity in Japan. One of the biggest credit card markets in the world, South Korea has maintained a preference for credit cards on day-to-day transactions. In the meantime, local payment applications such as KakaoPay and Naver Pay are on the rise.

MENA: Middle East and North Africa

In the MENA region, Cash on Delivery (COD) is still the preferred payment method —COD is especially prevalent in emerging e-commerce markets. But, as consumers become increasingly accustomed to doing business online, the use of digital wallets and credit cards is on the rise. More than half of consumers in the region now prefer online payments, a trend that is expected to gain pace in the coming years, according to a McKinsey survey.

Latin America

Local payment preferences — Brazil certainly differs from Mexico and Argentina — abound in Latin America. Brazilian consumers frequently use local payment systems Boleto Bancário and PIX, while Mexican shoppers prefer credit cards and OXXO cash payments. Digital wallets are becoming more prevalent in the region as well, particularly among younger consumers, with PayPal and local mobile payment tools seeing growing popularity.

Africa

Enhanced with DropSure: Revolutionize Your Dropshipping Journey!

Optimize your independent store operations with an all-in-one solution for payments, order fulfillment, and more! DropSure provides comprehensive support to simplify cross-border e-commerce processes. Whether you’re a new seller or an experienced operator, DropSure’s professional tools and services are designed to help you scale your business.

With seamless store integration, automatic order synchronization, and flexible logistics options, DropSure makes managing every transaction effortless. Plus, we offer multiple payment methods, including PayPal, bank transfers, and Airwallex, ensuring secure and fast fund transfers. Our branding customization features, order tracking tools, and robust after-sales support deliver a superior shopping experience that builds trust with your customers.

Join DropSure‘s affiliate program to earn additional income and explore new business opportunities. Make your e-commerce journey more efficient and successful. Sign up now to experience the power of DropSure and take the first step toward streamlined operations and rapid growth!

9 min read

9 min read